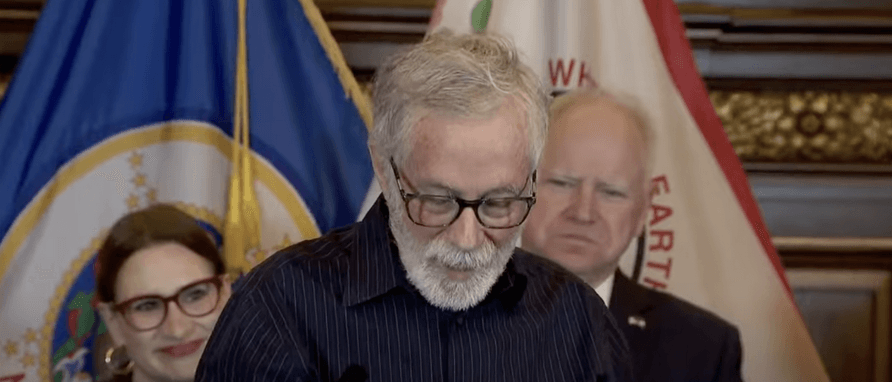

During the 2023-2024 legislative session, Minnesota passed the Debt Fairness Act and Governor Walz signed the Act into law on May 21, 2024. The Debt Fairness Act is a big step toward important medical debt reform and providing relief for countless Minnesota families dealing with medical debt. The law will go into effect this year on October 1, 2024—here’s how it deals with medical debt:

· A patient’s medical debt will no longer automatically transfer to their spouse. This means that after October 1, 2024, if a patient has medical debt, then their spouse is not personally liable for it. It is yet to be determined if this new law will apply to medical debt that is incurred before October 1st or if it will only apply to medica debt incurred on and after October 1st. Before the Debt Fairness Act, a patient’s spouse was automatically liable for the patient’s medical debt. This provision will help protect the financial stability of families and prevent many “medical divorces.” Patients should keep in mind, though, that medical debt creditors can still pursue the patient or the patient’s estate for collection of a medical debt.

· Medical providers will no longer be allowed to withhold medically necessary care from a patient due to the patient’s unpaid medical bills. This will apply to new and previously-incurred outstanding medical debt that the patient or their family member(s) owe on October 1, 2024 and after. If a patient or their family member has an outstanding bill, the medical provider is allowed to require the patient to enter into a reasonable payment plan before receiving the medically necessary care.

· Medical providers and health plans will be required to follow a process allowing patients to dispute billing errors. When a patient notifies their medical provider or health plan that the patient believes there is a billing error, the provider or plan must review the bill and correct any errors. During the review time, the medical provider will not be allowed to bill the patient for the disputed charges. Within 30 days after the review is complete, the medical provider or health plan is required to notify the patient: (1) that the review is complete, (2) what errors were corrected or why the bill is correct, and (3) include any applicable coding guidelines, references to health records, and other relevant information.

· Medical providers will no longer be allowed to report medical debt to credit bureaus. This will protect patients’ credit ratings from being harmed due to health circumstances beyond their control.

· Patients will have strong new protections against unethical debt collection practices for medical debt. Patients should consult with a debt collection defense attorney if they have questions about whether their rights under the Debt Fairness Act have been violated.

· Medical providers will be required to publish their medical debt collection practices. This will allow patients to be actively informed of when and how their medical provider may pursue them for recovery of a medical debt.

· Award attorney’s fees to patients who successfully defend medical debt lawsuits. Many times, patients do not or cannot challenge a lawsuit that is brought against them for collection of a medical debt because they cannot afford an attorney to help them defend against the lawsuit. This can and does result in some patients paying for medical debt that they should not be responsible for. This new law removes that barrier of legal costs for patients who do not rightfully owe a medical debt.

Cancer Legal Care is proud to have supported passage of the Debt Fairness Act on behalf of our clients and others in the Minnesota cancer community because we believe that medical debt has no place in burdening anyone’s cancer journey. We are thankful for the partnership between local community advocates and elected leaders in making this first step toward medical debt reform; and we are energized to see what progress is yet to come.